Gold hits record high as investors eye supportive backdrop into 2026 By Investing.com

Key Takeaways

- Gold prices surged to fresh record highs this week due to political turmoil and a U.S. government shutdown.

- Investors are flocking to safe-haven assets, benefiting gold and other precious metals.

- A company executive highlighted that past strategic acquisitions made at lower gold prices are now yielding significant value.

- Predictions suggest the current gold bull phase will continue, underpinned by central bank buying and U.S. debt.

- Analysts expect gold to remain well-supported into 2026 due to factors like government spending and expected Fed rate cuts.

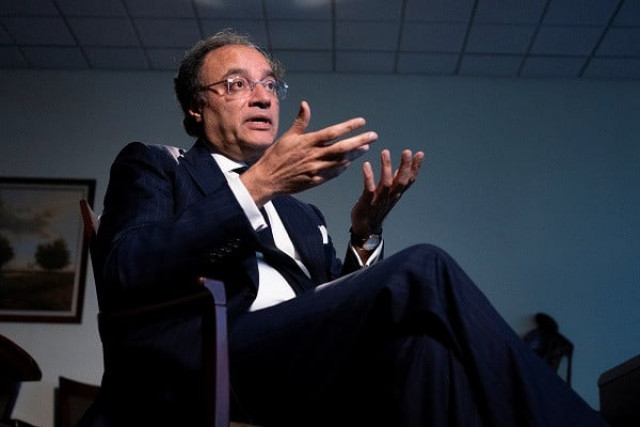

Gold prices surged to new record highs this week, with the rally attributed to political turmoil in Washington and the ongoing U.S. government shutdown, causing investors to seek safe-haven assets. This latest rise follows significant gains since late 2024, with one company executive, John McCluskey, noting that strategic acquisitions made between 2015 and 2017 when gold was priced between $1,100 and $1,300 have positioned them to drive shareholder value. McCluskey previously predicted gold could reach $3,800 and now believes the bull phase will continue due to underlying macro forces like central bank buying and U.S. debt levels. Max Baecker of American Hartford Gold described the surge as one of the strongest in history, with the metal up nearly 50% year-to-date. Baecker expects the strong support for gold to persist into 2026, citing expectations of continued government spending, slower economic growth, and anticipated Fed rate cuts as key long-term supportive factors.